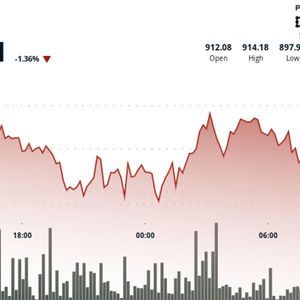

Dogecoin (DOGE), the leading memecoin in the cryptocurrency space, has faced significant challenges this week, experiencing a 22% decline. According to data from CoinGecko, DOGE is nearly 70% lower than its all-time high of $0.73. Despite these setbacks, analysts remain optimistic about Dogecoin’s future price performance. Dogecoin On Track For Major Rally The anticipated onset of an altcoin season in the last quarter of the year, combined with critical support levels, has contributed to a bullish sentiment among market watchers. Related Reading: All-Time Highs For Gold, S&P500; Crypto Stands Alone In The Red – What’s The Root Cause? Analysts at Bitcoinsensus have boldly asserted on social media site X (formerly Twitter), that Dogecoin is on the cusp of a significant upward movement, citing the cryptocurrency’s ascending trendline support visible on its weekly chart. Their analysis indicates that Dogecoin is mirroring the patterns of previous rallies that saw price increases of 300% and 500% between September and November of last year. This suggests that even with the current corrections pushing the price below $0.20, DOGE remains well-positioned to resume its upward momentum at any time. The crucial support level they identified stands at $0.14, a threshold that, if maintained, could lead to a rapid rebound. Bitcoinsensus forecasts a potential target of $1.30 for Dogecoin, implying an extraordinary rally of 800% for bullish investors. This is reinforced by the broader economic context, particularly in light of recent jobless claims and gross domestic products (GDP) reports. Path To Recovery, Key Support And Resistance Levels Analysts from The Motley Fool noted that weekly jobless claims for the week ending September 20 showed a decrease to 218,000, falling below expectations and indicating a resilient labor market. Meanwhile, the US Commerce Department revised its second-quarter gross domestic product estimate upward to 3.8%, reflecting robust consumer spending, the strongest quarterly growth seen in over two years. Such economic indicators could positively influence cryptocurrency prices, as investors often rotate from traditional assets like the Nasdaq and S&P 500 into riskier assets, including Dogecoin. This movement could potentially spark a new altcoin season, provided that sufficient liquidity enters the market. Related Reading: Ethereum Thesis From Tom Lee Torched As ‘Retarded’ By VC Firm Boss Looking ahead, Dogecoin faces key resistance levels that need to be overcome for a sustained recovery. The memecoin’s price has been rejected at $0.24 three times, with additional obstacles at $0.27 and $0.28. Achieving a breakthrough in these areas could set the stage for a move toward the $0.30 mark. Conversely, should DOGE retrace, strong psychological support is seen at $0.14, with further levels at $0.21, $0.19, and $0.16, which have historically acted as significant bounce points for the token. At the time of writing, the memecoin’s price attempts to stop its ongoing correction at $0.222. Featured image from DALL-E, chart from TradingView.com