The FTX Recovery Trust has confirmed plans to distribute a new round of reimbursements to creditors, marking another significant milestone in the ongoing effort to compensate those impacted by the collapse of the exchange. The entity, which was established to handle repayments after the platform’s bankruptcy, said the latest tranche will be worth around $1.6 billion. The distribution is scheduled for September 30, with creditors expected to see funds arrive in their accounts within three business days of the payment date. Breakdown of September’s Distribution According to details shared by the trust, the payout will be distributed across different categories of claims. Dotcom Customer claims will receive a 6% payout. US Customer Entitlement Claims will see a 40% distribution. General Unsecured Claims and Digital Asset Loan Claims will receive a 24% share. Convenience claims, which are capped at smaller amounts, will benefit from a 120% reimbursement as part of this latest tranche. This distribution follows two earlier payouts, which began earlier this year. In February, the trust released $1.2 billion to claimants, followed by a much larger $5 billion payout in May. Assets Set Aside for Creditors The FTX Recovery Trust has earmarked up to $16.5 billion to settle claims from creditors and former customers. The scale of these reimbursements reflects both the size of the exchange prior to its downfall and the magnitude of losses suffered when the company entered bankruptcy. The collapse of FTX in 2022 had a seismic effect on the cryptocurrency market. The event deepened the bear market that was already underway, eroding confidence in digital assets and sparking greater scrutiny from regulators worldwide. Even today, traders and investors watch developments around repayments closely, given the potential impact large inflows of capital back into the market could have on prices. Sam Bankman-Fried’s Conviction and Appeal The downfall of FTX has been closely tied to its former chief executive, Sam Bankman-Fried. In November 2023, he was found guilty on seven charges, including wire fraud, wire fraud conspiracy, securities fraud, commodities fraud conspiracy, and money laundering conspiracy. He was sentenced in March 2024 to 25 years in prison. Judge Lewis Kaplan, who presided over the trial, described Bankman-Fried’s actions and the collapse of the exchange as a “serious” crime that justified decades of imprisonment. Bankman-Fried’s attorneys are preparing to appeal the conviction this November. They have argued that he did not receive a fair trial, claiming he was effectively treated as guilty from the start. The defense has also asserted that FTX was not truly insolvent and that the company had sufficient funds to meet its obligations and repay customers. Market Implications With the third payout approaching, speculation continues over how these distributions might influence the wider crypto sector. Some analysts believe creditors receiving significant amounts of cash could lead to renewed investment in Bitcoin and other digital assets. Others caution that creditors may simply choose to exit the market altogether, pocketing their reimbursements instead of reinvesting. Either way, the September distribution represents another step forward in one of the most closely watched bankruptcies in recent financial history.

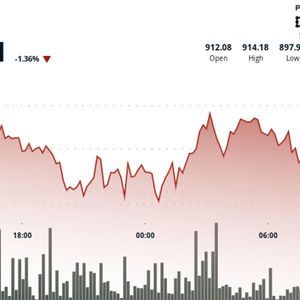

BNB slides to $900 as traders look to havens

BNB slides to $900 as traders look to havens