Bitcoin (BTC) continues to defend the $112,000 support level following days of tepid price action, unable to give a clear indication about the potential direction of its next move. Latest exchange data from Binance shows a recent dip in whale activity, suggesting BTC likely avoided another massive sell-off. Bitcoin Defends $112,000 Against Whale Sell-Off According to a CryptoQuant Quicktake post by contributor Arab Chain, recent data from the Binance crypto exchange shows that there was a sudden spike in whale activity on the exchange on September 7, when the BTC: Exchange Whale Ratio surged to 0.55. Related Reading: Bitcoin Withdrawal Wave Points To Another Major Leg Up In The Bull Cycle, Analyst Says However, this surge was quickly followed by a decline in the metric, as the BTC: Exchange Whale Ratio tumbled to 0.28, on September 8. However, the price remained stable around $112,500, suggesting that whale movements were short-lived and did not lead to a sell-off in BTC. The CryptoQuant analyst remarked that the fall in whale pressure toward the end of the period is a positive short-term signal. In essence, the likelihood of a sharp price correction driven by whale sell-offs on Binance is now significantly reduced. Arab Chain added: The frequent whale fluctuations in late August and early September highlight that major players are still moving large volumes – meaning risks remain, and the market could be caught off guard by a sudden move if substantial exchange inflows are converted into market orders. However, the analyst cautioned that the relationship is not always absolute. Although the rise in the metric has often been associated with a fall in the price of BTC, not every spike has led to a clear decline in price. As seen in the above chart, there have been instances of whale activity surging beyond 0.5 for multiple days – accompanied by positive net inflows to exchanges. Arab Chain noted that such dynamics may lead to a failure to maintain the $112,000 level, and possibly trigger a drop to $108,000. Historical data for September shows that the beginning of the month is typically quiet in terms of whale pressure on Binance, except for the occasional quick jump. While this offers a safer environment for a gradual rise, it also gives whales a chance to exert pressure on the market, especially if the overall demand is weak. Is BTC Yet To Hit Its Peak? While BTC is currently trading roughly 10% below its latest all-time high (ATH) of $124,128, some crypto experts opine that the flagship cryptocurrency is yet to hit its peak for this market cycle. Related Reading: Fair Value Gap Suggests Bitcoin Price Is Going Higher, But Watch Out For This Crash In recent analysis, Bitcoin researcher Sminston predicted that BTC may top out anywhere between $200,000 – $290,000 sometime in 2026. At press time, BTC trades at $112,639, down 0.1% in the past 24 hours. Featured image from Unsplash, charts from CryptoQuant and TradingView.com

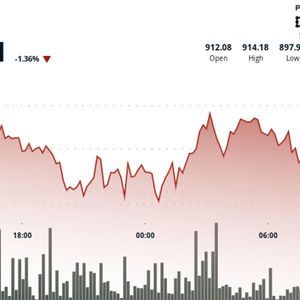

BNB slides to $900 as traders look to havens

BNB slides to $900 as traders look to havens