China exported 6,745 tons of rare-earth products in December, a drop from 6,958 tons in November, based on customs data released Sunday. The biggest chunk of the exports are rare-earth magnets, which have played a key role in past trade fights. China’s Ministry of Commerce had recently said it’s adding controls on shipments that could be used in military applications, with Japan clearly in mind. These two frenemies have been in a beef ever since Japan’s new prime minister Takaichi Sanae made comments about Xi Jinping’s very publicized plans for Taiwan, saying that she will come to the aid of the island nation should Beijing move forward with those plans. China Daily said Beijing is also thinking about tightening up license rules for shipping these critical rare earth materials to Japan. U.S. and allies hold meeting to reduce dependence The export numbers don’t show where the materials went or what types were shipped. That kind of breakdown is supposed to come out Tuesday. But even without details, governments are already reacting. China said back in October that these export restrictions will apply worldwide now, not just to specific countries. This is why the U.S. invited the G7 finance ministers, plus reps from Australia, India, South Korea, and the EU, to meet in Washington on Monday. The meeting was led by Treasury Secretary Scott Bessent, and the focus was on how to stop depending so much on China for rare earths. They talked about setting price floors to help other countries start their own rare-earth projects and build new partnerships to get supplies from different places. An official at the meeting said, “Urgency is the theme of the day. It’s a very big undertaking. There’s a lot of different angles, a lot of different countries involved, and we need to move faster.” Tensions grow over military use and economic pressure Right now, foreign companies need to get a license from China if they want to ship out rare earths or related tech. That system is now being used to slow things down or block exports to certain places, especially in defense and advanced tech sectors in countries like Japan, Europe, and the U.S. Jon Lang, who runs economic security policy at APCO in Washington, said the U.S. push to cut down on rare-earth reliance was “an easy sell” because of what he called China’s broad economic coercion. He also said the G7 is more united now than before. Lang added, “The meeting could also be seen as a show of support for Japan, as it had been an early victim of China using rare earths as a tool of trade coercion since 2010.” Not surprisingly, The Global Times, which is a Chinese state-owned tabloid, called the G7 talks a sign of America’s strategic anxiety. They said the West’s goal of beating China on rare-earth supply just won’t happen because of the way global demand and production look right now. Still, it’s obvious China is watching other countries invest more in new mining and processing centers. Nobody wants to rely on one country forever. Since the October announcement, there’s been a serious push around the world to build new supply chains for these critical materials. The smartest crypto minds already read our newsletter. Want in? Join them .

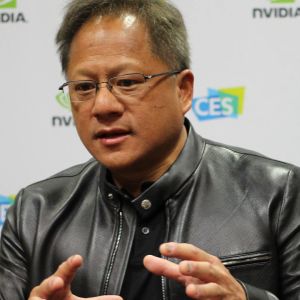

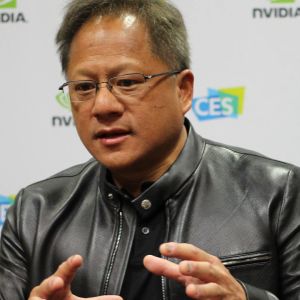

Nvidia's CEO predicts 'God AI' is on the way

Nvidia's CEO predicts 'God AI' is on the way