Paxos Trust has agreed to pay a $48.5 million settlement to the New York Department of Financial Services (NYDFS), resolving allegations that it failed to properly monitor illicit activity tied to its former partnership with Binance, the world’s largest cryptocurrency exchange. The settlement includes a $26.5 million civil penalty and $22 million allocated toward overhauling Paxos’s compliance program. Partnership with Binance exposed Paxos to illegal activity The NYDFS’s investigation focused on Paxos’s prior role in issuing Binance USD (BUSD), a U.S. dollar-backed stablecoin launched in partnership with Binance . From 2019 until early 2023, Paxos served as the regulated entity responsible for minting and redeeming BUSD under New York oversight. However, the regulator said that Paxos had “ systemic failures ” in its anti-money laundering (AML) program and lacked effective mechanisms to monitor suspicious activity on Binance’s platform, despite red flags. A mandated review revealed that between July 2017 and November 2022, approximately $1.6 billion in transactions on Binance were linked to illicit actors, including sanctioned individuals, darknet marketplaces, and Ponzi schemes. Binance also processed transactions involving entities blacklisted by the U.S. Treasury’s Office of Foreign Assets Control (OFAC), the review found. In February 2023, the NYDFS ordered Paxos to cease issuing BUSD. The firm promptly ended its relationship with Binance and has since attempted to reposition itself as a compliance-first blockchain infrastructure provider. Industry tensions over stablecoin compliance Binance itself was not named in the NYDFS case, but it has had its fair share of regulatory challenges globally. In November 2023, the exchange pleaded guilty to violating U.S. AML and sanctions laws and agreed to pay $4.32 billion in criminal penalties to the Department of Justice (DOJ) and other federal agencies. While the U.S. Securities and Exchange Commission (SEC) initially filed a civil lawsuit against Binance, the case was later dismissed in May 2025, reflecting what analysts say is a “more restrained” approach to crypto enforcement under President Donald Trump’s second term. Paxos will want to turn the page now Paxos now joins a growing list of crypto firms penalized for compliance deficiencies and risk oversight failures, which is not as egregious as others like FTX, which got indicted on outright fraud allegations. The company, which also partners with PayPal and Mastercard, has continued to expand its regulated blockchain infrastructure services and recently renewed its push for a national trust charter in the U.S. With the $48.5 million penalty now behind it, the company appears focused on distancing itself from its Binance past while reinforcing its credentials as a trustworthy player in the fast-growing stablecoin and tokenization markets. Want your project in front of crypto’s top minds? Feature it in our next industry report, where data meets impact.

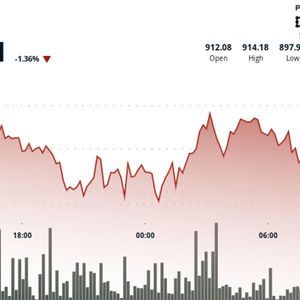

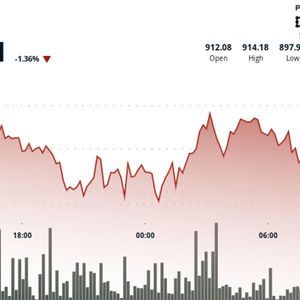

BNB slides to $900 as traders look to havens

BNB slides to $900 as traders look to havens