With its price surging sharply to new all-time highs this year , BNB (The Binance native coin) is now one of the best-performing cryptocurrency assets in the ongoing bull market cycle. While the altcoin is currently holding strong above the $1,300 price mark, several key factors have been identified as likely responsible for the recent upward trend to new heights. What Pushed The price Of BNB To New Highs BNB keeps surpassing market expectations, breaking through barriers, and reaching new all-time highs as the cryptocurrency market is swept by bullish momentum. In a recent quick-take post on the CryptoQuant platform, a market expert with the nickname XWIN Research Japan has outlined the possible triggers of the altcoin’s strong upside action this cycle. As of October 8, the Binance coin experienced a spike to $1,300, exhibiting the best performance among major cryptocurrencies. With this remarkable growth, BNB has grown from being viewed as just the native token driving Binance’s ecosystem to becoming a major player in DeFi and Web3. According to XWIN Research Japan, the ongoing surge is beyond a short-term speculative move . The expert has solely attributed the upward move to Binance’s structural recovery and deeper integration with traditional finance. Presently, on-chain data are showing robust buying momentum in the market as observed in the Spot and Futures Taker CVDs. As observed in the chart, spot and futures Taker CVDs are trending upward, which is an indication of a resurgence in buyer dominance. In addition, the Binance Dominance Strength – Share of Stablecoin Reserves vs Market Total, shows that its share of ERC-20 stablecoin reserves has increased to nearly 70%. This marks its highest level ever recorded in years. Interestingly, this concentration of liquidity provides a solid foundation for BNB’s strength by generating genuine demand for trading, staking, and Launchpad participation. While sentiment has improved, XWIN Research highlighted that this happened after Changpeng “CZ” Zhao, the founder of Binance , reinstated the “Binance” title on his profile on X, a move signifying regulatory stability. At the same time, Binance’s quarterly burn of about 2 million BNB, or $1 billion, keeps supply tight, directly connecting scarcity to volume expansion and platform growth. Multiple Collaborations Done This Cycle With BNB rising, investors’ conviction in the altcoin has risen. Another factor that has bolstered investors’ confidence is Binance’s partnerships with global financial institutions. These include Collaborations with Franklin Templeton to co-develop tokenized securities (RWA) and with Chainlink to bring US economic data on-chain , which mark important advances toward institutional-grade DeFi. There have also been key projects launched on the BNB chain , such as the new Crypto-as-a-Service (CaaS) initiative. The main use case of this initiative is to enable banks and brokerages to provide crypto services under their own brands, reflecting Binance’s shift from exchange to financial infrastructure provider. Meanwhile, for BNB , the strong institutional links, deflationary supply mechanisms, and liquidity concentration have transformed it from a straightforward exchange token into a vital asset that connects Web3 and conventional banking. Such shifts represent a blatant indication of Binance’s fresh supremacy in the digital market.

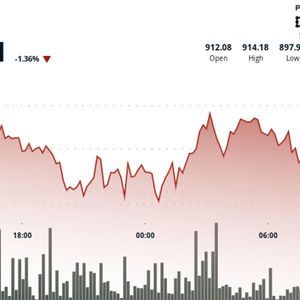

BNB slides to $900 as traders look to havens

BNB slides to $900 as traders look to havens