BitcoinWorld Innovative Traditional Asset Exchange Launches with $35M Backing from Former FTX President In a bold move that bridges two financial worlds, Brett Harrison, the former president of FTX US, has secured $35 million in funding. His mission? To launch a groundbreaking traditional asset exchange that borrows the best ideas from cryptocurrency markets. This venture, named Architect Financial Technologies, signals a fascinating convergence of old and new finance. What Is This New Traditional Asset Exchange? Architect Financial Technologies, or AX, isn’t just another trading platform. Instead, it aims to revolutionize how we trade familiar assets like stocks and foreign exchange. How will it do this? By applying innovative design principles perfected in the crypto space, particularly for perpetual futures contracts, to these mainstream markets. This approach could solve long-standing issues in traditional finance. For example, it may offer deeper liquidity, more transparent pricing, and access to trading 24 hours a day, seven days a week. Therefore, this traditional asset exchange could become a powerful new tool for professional traders and institutions. Why Does This Crypto-to-Traditional Move Matter? The collapse of FTX left many questioning the future of crypto innovation. However, Harrison’s new project demonstrates that the underlying technology and market structures have valuable lessons to teach. The core idea is to take what works—efficiency, accessibility, and novel product design—and apply it to a more regulated, established arena. Consider these potential benefits for a trader on this new traditional asset exchange : Continuous Trading: Trade traditional assets like stocks or forex pairs at any time, similar to crypto markets. Enhanced Leverage Products: Access sophisticated perpetual futures contracts for assets beyond just cryptocurrencies. Improved Market Efficiency: Benefit from crypto-inspired mechanisms that could reduce fees and slippage. What Challenges Will This Traditional Asset Exchange Face? Building a bridge between two different financial cultures is no simple task. The primary hurdle will be regulation. Traditional securities and forex markets are heavily overseen by bodies like the SEC and CFTC. Gaining the necessary licenses and ensuring full compliance will be critical for AX’s success and legitimacy. Moreover, the startup must win the trust of institutional players. After the FTX debacle, any venture linked to its former executives will face intense scrutiny. Consequently, Architect must operate with unparalleled transparency and robustness to attract its target user base. A Compelling Vision for the Future of Finance This $35 million funding round is a strong vote of confidence in Harrison’s vision. It shows that investors believe the fusion of crypto market mechanics with traditional assets is a viable and potentially lucrative path forward. This traditional asset exchange could be a pioneer, setting a new standard for how all financial markets operate in the future. In summary, Architect Financial Technologies represents more than just a new company. It embodies a transformative idea: that the innovation born in crypto can upgrade the entire global financial system. The journey will be complex, but the potential reward is a more efficient, accessible, and modern marketplace for everyone. Frequently Asked Questions (FAQs) What is Architect Financial Technologies (AX)? AX is a new financial technology startup founded by Brett Harrison, former president of FTX US. It is building a trading platform, or traditional asset exchange , for assets like stocks and forex using design principles from cryptocurrency markets. What are perpetual futures contracts? They are a type of derivative contract, very popular in crypto trading, that has no expiry date. Traders can hold positions indefinitely, making them a flexible tool for speculation and hedging. AX plans to offer these for traditional assets. How much funding did Brett Harrison raise? Harrison has raised $35 million in venture capital to launch and develop Architect Financial Technologies. Is this related to the failed FTX exchange? While the founder is a former FTX executive, Architect is an entirely separate and independent company. It is focused on regulated traditional assets, not cryptocurrencies. When will the AX exchange launch? As of this reporting, a specific public launch date has not been announced. The company will likely need to complete regulatory approvals first. Who is the target user for this platform? The platform appears aimed at sophisticated traders, hedge funds, and financial institutions looking for advanced trading tools and continuous market access for traditional assets. Found this look at the future of finance intriguing? Share this article with your network on social media to spark a conversation about how crypto innovation is reshaping traditional markets! To learn more about the latest trends at the intersection of crypto and traditional finance, explore our article on key developments shaping institutional adoption and market structure evolution. This post Innovative Traditional Asset Exchange Launches with $35M Backing from Former FTX President first appeared on BitcoinWorld .

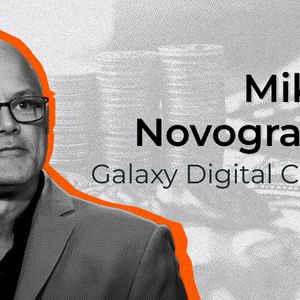

Bitcoin (BTC): Novogratz Admits He Was Wrong

Bitcoin (BTC): Novogratz Admits He Was Wrong