Following the sharp decline in Bitcoin (BTC), Michael Saylor's company, Strategy, is in the spotlight. With Bitcoin falling below $81,000 today, the timing of the company's massive BTC portfolio entering loss territory has once again become a topic of discussion. Strategy holds a total of 649,870 BTC. The portfolio's current market capitalization is $54.24 billion, and the company's average cost is $74,433. Based on this level, Strategy still appears to be 12.13% profitable (approximately +$5.86 billion). However, the rapid decline in Bitcoin suggests that critical levels are approaching. In a year-over-year comparison, Strategy shares are down 59.02%, while Bitcoin is down 15.72%. The difference is -43.30 points, revealing the erosion of the company's market value. Related News: Richest Names in the Cryptocurrency World Ranking Has Changed - Most Are Worth Billions, Yet They Can't Touch a Single Cent Despite this, Michael Saylor says he's not worried. In an interview with Fox, he argued that Strategy could “survive even an 80-90% Bitcoin decline by continuing its operations.” Saylor downplayed comments suggesting the company's growing BTC position would come under pressure as the market declines. Saylor noted that Bitcoin has experienced 15 major declines over the past 15 years, but has hit new highs each time, saying the sharp corrections “cleaned out leveraged positions and weak investors.” He also noted that Bitcoin volatility has dropped from 80% to 50% year-over-year compared to Strategy's initial purchases in 2020. *This is not investment advice. Continue Reading: How Much Further Down Could Bitcoin Go Before Big Bull Michael Saylor Starts Losing Money? Here’s That Critical Level

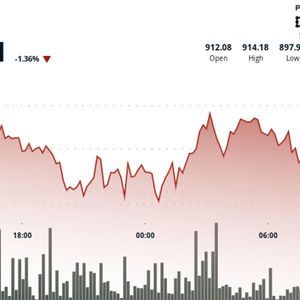

BNB slides to $900 as traders look to havens

BNB slides to $900 as traders look to havens