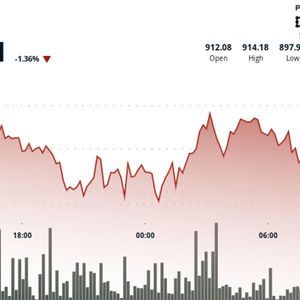

Solana ($SOL) is at a critical juncture as traders and investors closely monitor its price levels and potential institutional adoption. After a recent pullback, the cryptocurrency now hovers near $196, reflecting a 3.98% drop in the past 24 hours and a 20.09% decline over the week. Analysts emphasize that Solana’s near-term trend largely depends on overcoming resistance zones while maintaining strong support levels. Crucial Resistance at $218 Ali Martinez, a market analyst, highlights $218 as a major supply wall for Solana. The UTXO Realized Price Distribution (URPD) chart indicates nearly 29 million SOL were acquired around this level, representing 4.8% of total supply. This concentration creates a cluster of potential sellers seeking to break even, potentially triggering profit-taking if the price approaches $218. Below this zone, Solana enjoys strong support between $165 and $180, where large volumes were previously transacted. If bulls can break past $218, the path toward $238–$250 opens, offering lighter resistance. Conversely, repeated rejections may reinforce consolidation and pressure Solana downward. Source: X Bounce Potential Near $194 Another analyst, Tom Tucker, points out that Solana recently moved beyond its 0.618 Fibonacci retracement at $200. The Relative Strength Index (RSI) sits deep in oversold territory, suggesting a possible bounce if $194 holds. This combination of technical support and oversold momentum makes the current price zone a watch area for traders anticipating a short-term recovery. Consequently, a successful rebound could set the stage for renewed upward momentum toward higher resistance levels. Institutional Interest and ETF Impact Beyond technical trends, Solana could gain significantly from institutional adoption. Pantera Capital notes that institutions currently hold less than 1% of Solana’s supply, compared to 16% of Bitcoin and 7% of Ethereum. Potential Grayscale spot ETF approval on October 10 could dramatically boost institutional participation, providing direct exposure to Solana. Additional applications from Bitwise, VanEck, and others await SEC review through October 16.