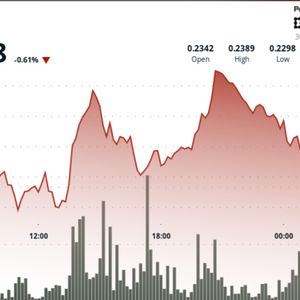

Bitcoin and Ethereum ETFs experienced their worst weekly stretch since debut, as risk appetite declined and investors de-risked heading into quarter-end. U.S. spot Bitcoin ETFs saw approximately $902.5 million in net outflows for the week of Sept. 22–26, ending a four-week inflow streak. Ethereum ETFs lost about $795.6 million, marking their largest weekly redemptions since launch. The outflows were uneven: Fidelity’s FBTC led BTC outflows, while BlackRock’s IBIT and Invesco’s BTCO defied the trend with $173.8 million and $10 million of inflows, respectively. On the ETH side, several issuers experienced large single-day withdrawals, showing how quickly flows can reverse when macro risk increases. Macro Headwinds Keep Buyers Cautious The reversal came as traders weighed new U.S. tariff announcements and lingering uncertainty about the Fed’s rate cuts ahead of key inflation data. Those headlines revived fears of a growth and liquidity squeeze, driving a quick reset across risk assets. Bitcoin briefly slipped below pivotal support intraday before rebounding, while Ethereum mirrored the move with a shallow bounce. Despite the week’s pain, September still shows net inflows for Bitcoin ETFs ($2.57B), a notable improvement from August’s outflows, evidence that institutional adoption remains intact. For now, the market’s message is clear: without a more dovish macro backdrop or cleaner inflation prints, allocators may remain selective, trimming core BTC/ETH exposure when it is strong and adding only on clear confirmations. Alternative Crypto ETFs Take Spotlight Over Bitcoin and Ethereum Beneath the headline of redemptions, some desks report rotations toward thematic or alternative crypto ETFs (e.g., Solana, XRP) as allocators seek uncorrelated catalysts. That discussion overlaps with speculation about a potential BlackRock XRP spot ETF , with market models suggesting $4–$8B of first-year inflows if such a product were filed and approved. Although no filing has been confirmed, XRP’s quick settlement times and low fees keep it on institutions’ radar. Nevertheless, the week’s outflows serve as a reminder: macro factors outweigh micro in the short term. As October progresses, focus on whether BTC funds resume steady inflows, if ETH redemptions decrease, and how upcoming inflation data influences Fed expectations. Until these factors align positively, volatility will remain high, and ETF flow reports will continue to be the best real-time indicators of institutional confidence. Cover image from ChatGPT, BTCUSD chart from Tradingview

This Whale’s XRP Monster Buy Stuns XRP Army

This Whale’s XRP Monster Buy Stuns XRP Army