Recent blockchain data shows steady Bitcoin deposits moving into wallets associated with major US custody providers, even as smaller investors pull back. Despite reduced retail activity, new BTC supply continues to accumulate in these holdings. CryptoQuant founder Ki Young Ju said on X that wallets holding between 100 and 1,000 BTC, excluding exchanges and miners, have added about 577,000 BTC over the past year, worth roughly $53 billion, with inflows still ongoing. Institutions continue to buy BTC through large custody wallets slowly Institutional demand for Bitcoin remains robust and accelerating, according to new on-chain data analyzed by CryptoQuant, a leading blockchain analytics platform. Over the past 12 months, entities such as institutional custody wallets and Bitcoin exchange-traded funds (ETFs) have added significant holdings, signaling confidence in Bitcoin’s long-term value. Large custody wallets now hold roughly 1.3 times as much BTC as they did 2 years ago, a growth mirrored by the steady rollout of US spot Bitcoin ETFs . The real story here is not panic purchases during frenzy periods. Instead, steady movement began when rules became clearer. Big players seem focused less on price swings. Their attention leans toward systems they can actually plug into. Expansion happened as tools arrived, not because headlines heated up. Bitcoin’s price rose, but uncertainty lingers across trading arenas. This year shows a 6% advance; meanwhile, large investors add more, showing they care less about quick losses. Over weeks, things come into focus slowly: consistent buying points to real faith, untouched by hourly shifts. One thing becomes clear: long-run dedication comes not from panic but from foresight. ETFs and digital treasuries help big investors keep buying Bitcoin for the long term Even now, spot Bitcoin ETFs hold steady as big players lean on them to stay involved without wrestling with custody issues. These funds offer a clear path through rules everyone knows, sidestepping storage hassles. Since January, US spot Bitcoin ETFs pulled in $1.2 billion more than they lost. That flow hints at quiet confidence where cash keeps moving in while markets wobble and feelings swing one way then another. Even with consistent ETF inflows, fresh pressure emerges as corporate treasuries embrace digital assets, deepening existing accumulation patterns. Since July, firms focused on Bitcoin, notably guided by Michael Saylor’s approach , have gathered close to 260,000 coins, valued at nearly $24 billion today, revealing intent shaped by durability rather than timing. Recorded ownership of BTC pulls substantial volume out of circulation while quietly affirming its endurance as a store of value over the years. Market dynamics shift subtly when such holdings take root, altering supply availability without announcement or fanfare. When set against Bitcoin’s limited issuance, rising interest gains significance. Notably, corporate vaults now hold over 1.1 million coins – an increase of 30% within half a year – according to Glassnode figures. This buildup outpaces the flow of newly mined units entering the market. With fewer coins accessible on exchanges, large participants seem active during downturns. Despite rising nervousness among individual traders, reflected in increasingly fearful sentiment, institutions continue to buy. This pattern aligns with CryptoQuant’s findings, showing that demand is driven by long-term positioning rather than short-term reactions to price swings. Sharpen your strategy with mentorship + daily ideas - 30 days free access to our trading program

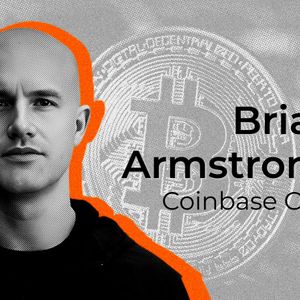

Coinbase CEO Urges Banks to Start Competing

Coinbase CEO Urges Banks to Start Competing